What is Arbitrage Bot (Moderate Mode)?

“Arbitrage bot (Moderate Mode)” is a low-risk financial bot adopting a hedging strategy, which annualized rate of return is 5% – 50%. During the period of 2020/9/15-2021/9/16, the total return was 28.35%, and the max drawdown was 1.28% during this period.

Bearing little risk, if you are still seeking a financial management strategy that has a much higher rate of return than savings, Picol “Arbitrage bot (Moderate Mode)” is exactly what you are looking for.

How does the bot make arbitrage profits?

After trading off between the risk and return, “Arbitrage bot (Moderate Mode)” takes ETH as the only coin to arbitrage.

The bot buys ETH in the spot market while selling ETH (open short) of the same amount in the futures market. By this method, the arbitrage bot is able to receive interests (funding fees) paid to the short position while keeping a market-neutral portfolio.

Hedging: Keep your principal riskless

Hedging is a strategy to offset potential losses or gains that a companion investment may incur. A hedger will sell coins in the futures market in advance to lock in the current profit to avoid potential loss caused by price fluctuations.

Picol arbitrage bot adopts this strategy.

Let’s say we have 10,000 USDC for the spot-futures arbitrage bot (Moderate Mode) while each ETH is worths 4,000 USD in both spot & future’s market:

1. The bot will first buy 2.5 ETH in the spot market and then sell it in the futures market and open a short position worth 10,000 USD.

2. As you sold all the ETH for USD, you are equivalent to holding 10,000 USD in the futures market. In this case, the value of your assets will never change regardless of the price fluctuation of ETH.

When you close the bot:

- If the price of ETH surges up to 10,000 USD/ETH, you will get 1 ETH after you close your short position. And after selling it in the spot market, you will get your 10,000 USDC back safely.

- If the price of ETH goes down to 400 USD/ETH, you will get 25 ETH after you close your short position. And after selling it in the spot market, you will still get your 10,000 USDC.

Funding fee: Your arbitrage profit

Perpetual contracts are widely offered by crypto-derivative exchanges, and it is designed similar to traditional futures contracts.

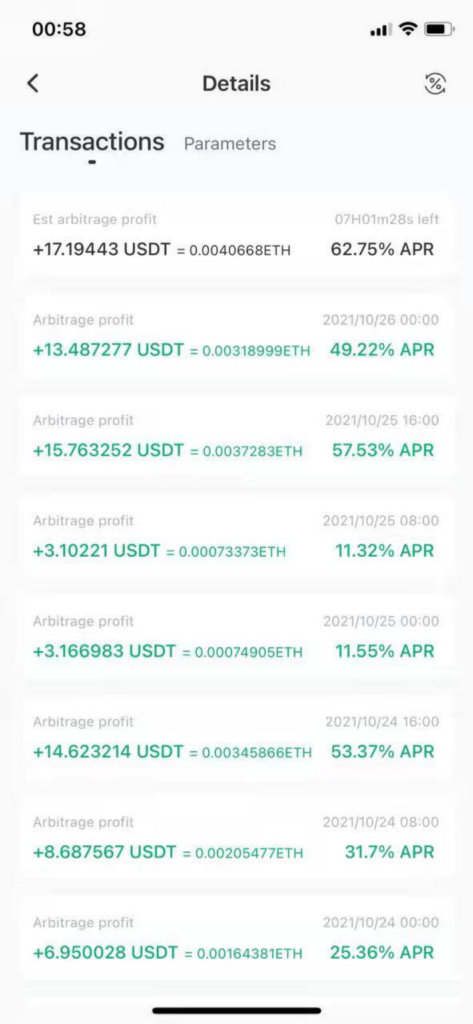

The most important differences between traditional contracts and perpetual contracts are that perpetual contracts don’t have an expiration date. Since perpetual futures contracts never settle in the traditional sense, exchanges introduced funding rates to ensure that futures prices and index prices converge on a regular basis. Funding rates are periodic payments (settled every 8 hours at UTC+0 0:00, 8:00, 16:00) either to traders that are long or short based on the difference between perpetual contract markets and spot prices:

- When the price of the perpetual contract is much higher than that of the spot, the funding rate is positive. Thus, traders who are long pay for short positions.

- Conversely, when the price of the perpetual contract is much lower than that of the spot, the funding rate is negative. Thus, traders who are short pay for long.

- When the prices in the two markets are pretty close, the long position should pay interest to the short, fixed at 0.03% daily. The funding rate will be 0.01%, and the long pay to the short.

The funding fee is the arbitrage profit earned by the Picol arbitrage profit. The funding fee will be settled to your account every 8 hours by holding a short position in the perpetual futures market.

According to the historical data of the ETH funding rate on Binance, in most cases, the short position will receive funding fees paid by the long position. During 2020/9/15-2021/9/16, 90% of the funding rates are settled at positive, and the max drawdown caused by the negative funding rate was only 1.28% during the whole year.

Besides, when the prices surge, the funding fee will be extremely high, and the annualized rate of return for the arbitrage could reach up to 100%+ in one settlement.

Why do you need the bot to arbitrage?

- Easy to use: Arbitrage in one-touch. Fill in the investment amount and then click “create” to start now.

- Auto-settlement: After receiving the funding fee, the bot will automatically settle it by adding to the short position. By doing so, you can get compounding interest by auto-settlement.

- Guaranteed: Your investment is protected by the SAFU program in extreme market conditions.

- High efficiency: Picol only charges a fee of 0.05% for spots, which is much lower than most exchanges. Besides, compared to manual arbitraging, the bot can buy the spot and open the short position simultaneously, avoiding the increasing price gap caused by the time difference between buying and selling.

What are the risks of using the arbitrage bot?

The arbitrage bot (Moderate mode) adopts the arbitrage strategy with extremely low risk. The only risk is that the short position is auto-deleveraged (ADL) and the bot failed to sell the ETH in the spot market in time.

However, the occurring probability of this case is extremely small. Firstly, auto-deleveraged will only happen when there is a sudden drop in the ETH price. Additionally, as the arbitrage bot (Moderate mode) is not leveraged, the short position ranked at the bottom in the ADL list.

What are the differences between “Moderate mode” & “Aggressive mode”?

- Support earning with regulated stable coins: “Moderate mode” supports earning with USDT, USDC, and BUSD, while “Aggressive mode” only supports investing with USDT.

- 100% fund utilization rate: The “Moderate mode” has a 100% fund utilization rate, while the rate of “Aggressive mode” is peaking at 75% (with 3x leverage).

- Lower risk: The strategy “Moderate mode” adopted is not leveraged and will never have the possibility of liquidation. However, “Aggressive mode” keeps a short position with 1-3 times leverage.

- No extra fee during running: As the position of “Moderate mode” is not leveraged, the arbitrage bot does not need to perform auto-deleverage to decrease the risk of liquidation. You don’t need to pay the fee without auto-deleverage and are free from suffering a loss caused by auto-deleverage when the bot is running.

- “Aggressive mode” has a more diversified setting: In “Aggressive mode”, you can choose altcoins to arbitrage while you can only choose ETH to arbitrage in “Moderate mode”. Besides, “Aggressive mode” supports multiple customizations, including price gap control and leverage setting.

FAQ

Q: Can I start the arbitrage bot with only 100 USD?

A: Yes, the minimum investment required is 100 USD. And you can invest up to 250,000 USD in this bot.

Q: Does it make any difference if I invest with USDT, USDC, or BUSD?

A: The total rate of return will be the same no matter you invest with which stable coin. The only difference is that if you invest USDT, your profit will be settled in USDT; if you invest BUSD, your profit will be settled in BUSD, etc.

Q: Can I release profit?

A: No, all arbitrage profits will be auto-settled and used to add to the short position to help you to get the compound rate. “Withdraw investment” if you need the funds.

Q: I opened ETH/USDT arbitrage bots in both “Moderate mode” and “Aggressive mode” and I find that the “Next funding rate” is different for these two modes, why?

A: Because the two modes adopt different arbitrage strategies, they kept their short position with different kinds of futures.

Q: What should I do if I find the next funding rate is negative?

A: It will be better to keep the bot running when the funding rate is ≥-0.2%. If the funding rate is <-0.2% and is close to the settlement time, it would be better to close the bot.

In most cases, the negative funding rate will be turned to positive when settled. Besides, if we also take the open and close fee into consideration, it will be better to keep the position when there is only a tiny negative funding fee payout.